How to access the benefits of the Inflation Reduction Act

A Cost-Effective Route to Renewable Energy for Retailers

- By [ Hans Royal ]

- 08/01/2024

Intro

As the push for corporate decarbonization continues to gain momentum, retailers are facing increasing pressure to meet sustainability targets while managing costs. The Inflation Reduction Act (IRA) of 2022, introduced a mechanism to monetize tax credit incentives known as Transferability. Transferability allows the transfer of renewable energy tax credits via a Tax Credit Transfer (TCT). By utilizing TCT, retailers can reduce their US federal income tax bill by 2-12%, and utilize that savings for procuring Renewable Energy Certificates (RECs) or to fund other sustainability initiatives.

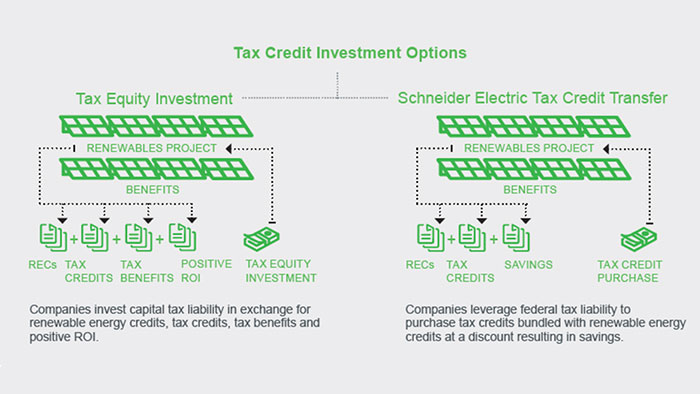

Prior to the IRA, corporates were generally only able to invest in offsite renewable energy projects and achieve a reduction in income tax only through a tax equity partnership, a complicated transaction requiring equity ownership in a renewable energy project. The complexity involved in tax equity transactions made this option unattractive for many companies and therefore, was not entirely successful at unlocking direct corporate investment into offsite renewable energy projects. Since the introduction of transferability in 2022, tax credits can now be bought and sold one time. In addition, it is no longer a requirement to be an equity investor in a renewable energy project to purchase these tax credits. Since many developers cannot monetize the tax credits themselves, as most lack the taxable income needed to have a federal income tax bill, they can now sell these tax credits to corporations with tax liability. This has been a game changer in unlocking much-needed corporate capital to speed the transition to a clean grid in the United States.

Ultimately, what TCT provides is an opportunity to directly invest in solar or wind projects (and other clean energy asset classes) in exchange for tax relief. The savings provided by the tax credits create positive cash flow for the corporate buyer, which can then be used to fund decarbonization initiatives, such as the purchase of Renewable Energy Certificates, or to provide additional savings to shareholders.

What is TCT and Why Does it Matter?

Tax Credit Transfer represents a transformative approach for businesses to engage with renewable energy projects in a financially viable manner. At the core of TCT is the principle of harnessing the economic incentives provided by tax credits, which are pivotal in forming the capital stack that renewable and other clean energy developers need to construct their projects.

The mechanism functions by allowing entities with unused tax credits to partner with others who can effectively utilize these credits, facilitating a symbiotic relationship that fuels investment in sustainable energy solutions. The importance of this arrangement cannot be overstated, as it broadens the scope of companies that can contribute to and benefit from the shift towards clean energy, a crucial step in addressing global sustainability challenges.

In addition, TCT can be a powerful tool in a retailer’s decarbonization arsenal, as the ability to qualify for TCT is not dependent on whether a company owns or leases its sites, electricity load, nor its geographic footprint.

Example: Accelerating Renewable Energy Growth through Strategic Collaboration

Overview: Schneider Electric's $80-million investment in a Texas-based clean energy portfolio was enabled by a Tax Credit Transfer (TCT) Agreement and showcases a pioneering approach to accelerating corporate renewable energy procurement. Leveraging the transferability clause in the Inflation Reduction Act (IRA), the company is committed to helping achieve its 100% renewable energy goal in the U.S. and Canada.

Challenges: Meeting renewable electricity targets in the U.S. and Canada while reducing Scope 2 emissions posed significant challenges such as the scalability, financial, and risk profiles of various solutions, as well as regulatory, technological, and market considerations.

Proposed Solution: Schneider Electric's collaboration with ENGIE North America on solar and battery storage projects, utilizing the IRA's tax credit transfer provisions, presented an innovative solution. This approach not only aligned with the company's sustainability goals but also facilitated the transfer of federal tax credits from renewable and clean energy projects, providing an appealing alternative to traditional tax equity structures.

Results: The agreement with ENGIE and the utilization of tax credit transfer provisions should enable Schneider Electric to help meet its 100% renewable energy goal ahead of schedule, and at no extra incremental cost. The innovative tax credit transfer structures have expanded opportunities for corporate clients while supporting the growth of renewable energy and storage options in the U.S. The company will utilize its tax-credit savings to procure 110,000 megawatt-hours of renewable energy credits (REC) annually for 10 years.

Conclusion: Through its Renewable Energy Tax Credit Investment offer, Schneider Electric guides enterprises through the complexities of the post-IRA tax credit landscape. In addition, the company walks the talk in its own decarbonization journey, and is slated to be on the path to achieve its 100% renewable energy goal well ahead of schedule by leveraging Tax Credit Transfer strategy.

How Schneider Electric Can Facilitate Your Journey to Renewable Energy through TCT

As an independent and unbiased buyers’ agent, Schneider Electric offers comprehensive visibility into a variety of clean energy solutions, including Clean Energy Tax Credit Transfer. To delve deeper into this subject, consider checking out our recent webinar featuring Hans Royal, Senior Director, Renewable Energy & Carbon Advisory, and Emily Rose, Associate Director, Head of Renewable Energy Tax Credit Investing. This webinar provides a valuable opportunity for a more in-depth exploration of tax credit transfers.

Schneider Electric was ranked #1 in Time Magazine’s World Most Sustainable Companies for 2024.

Discover More: Explore how Schneider Electric can enhance your TCT strategy.

Related from RILA

RILA maintains an IRA and IIJA Funding Opportunities for Retail resource, outlining how retailers can take advantage of direct and indirect opportunities to accelerate decarbonization.

Want to learn more about RILA’s Sustainability work and ongoing Strategic Partnership with Schneider Electric? Reach out to Erin Hiatt, VP of CSR at RILA.

Please note, the information and content presented in this blog represents the views, thoughts, and opinions of our strategic partner and should not be interpreted as representing the views, thoughts, or opinions of RILA on this topic.

Tags

-

Energy

-

Retail Sustainability

-

Sustainability & Environment

-

Tax