Wall St Uses Bogus Rewards Argument in Credit Card Debate

- By [ Austen Jensen ]

- 07/24/2023

First, the bipartisan Credit Card Competition Act would create competition in the payment space by allowing smaller companies to compete for business, creating new options for local retailers and restaurants to choose which networks transactions are routed over for processing—that has nothing to do with rewards. Rewards are determined by banks, not networks, and are used as a marketing tool to convince consumers to choose a Visa or Mastercard credit card from one bank over another. Competition on routing payments won’t regulate how, when, or why credit cards offer rewards. Suggesting otherwise is simply a scare tactic to protect a broken market.

Further, many retailers offer rewards of their own through loyalty programs and manage to do so even with an average profit margin of under 3 percent. By comparison, the money center banks that issue the vast majority of credit cards have an average profit margin of 27 percent. Why are banks trying to squash competition with margins like that?

Moreover, rewards have not gone away in other countries where we have seen these legislative policies adopted. A decade after reform in Australia, the Reserve Bank of Australia found banks still offered “significant credit card rewards” despite Visa and Mastercard claims that rewards would go away. These claims have been proven to be bogus, and American policymakers shouldn’t be duped.

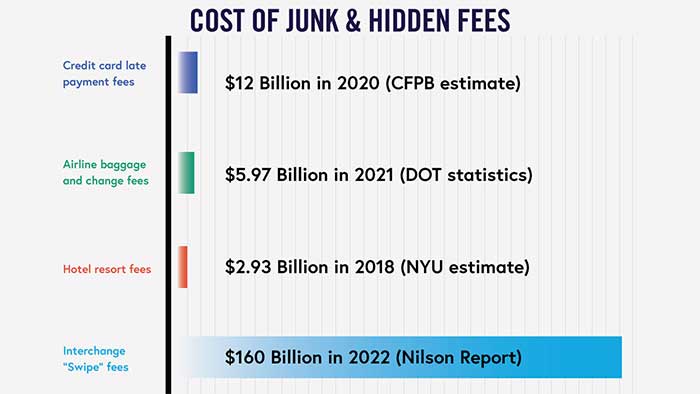

Finally, its worth noting that American families are sick of fees. Resort fees, change fees, baggage fees, convenience fees, concert fees—you name it, banks and their allies seem to find new ways to stick it to consumers every single chance they get. Swipe fees are the most insidious of these fees because they are rarely seen, yet they dwarf other rackets and drive up the cost of everything—food, clothes, travel, entertainment—they cost consumers an estimated $160 billion dollars just for using their credit cards on everyday purchases.

See Austen Jensen’s brief interview on the topic here.

Tags

-

Competition

-

Payments

-

Public Policy

-

Finance

-

Supporting Free Markets and Fostering Innovation