Looking Ahead: Payments Policy Outlook in 2025

Tracking the election impact on retail policy priorities

- By [ Austen Jensen ]

- 11/21/2024

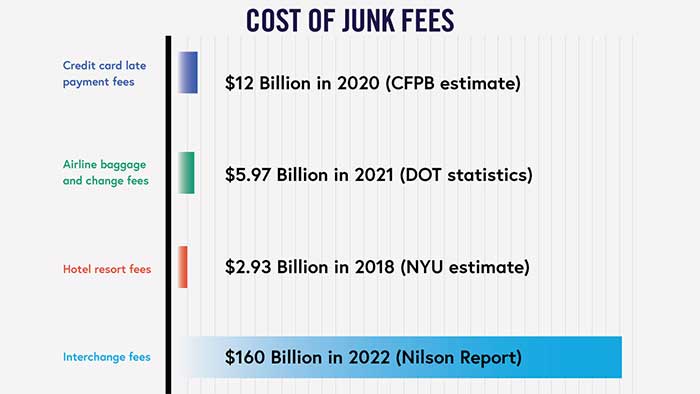

Merchants in the United States pay some of the highest interchange rates or “swipe fees” in the world, costing merchants more than $170 billion each year. The global card companies, along with major issuing banks, establish these rates in an anticompetitive manner. Over the past couple of years, with RILA’s leadership, the Federal Reserve and other federal agencies have taken actions supporting retailers and attempting to limit the control of the dominant credit card networks and Wall Street banks.

In October of 2023, the Federal Reserve unveiled a proposed rule that represents the most substantial and pivotal reforms to the Durbin Amendment, which governs interchange rates for debit cards. The rule proposed to lower the debit interchange level from roughly 21 cents to 14 cents. The board voted almost unanimously (6-1) to move the proposed regulation forward. Under the Fed’s current timeline, RILA expects the rule to be released in early 2025. Importantly, the Fed also proposed a mandatory biannual review of the debit interchange rate providing continued opportunities for the rate to be updated.

ELECTION IMPACT

With Republicans in complete control of the House, Senate and White House, there could be an effort by the new Republican led Congress to weaken the Durbin Amendment. RILA expects to see legislation reintroduced to study and delay the lowering of the debit rate again in the next Congress under GOP control. This is a direct response from the banking sector and their allies on the Hill to weaken the final rule in light of the Federal Reserve’s decision to lower the rate. With only slim majorities in either chamber, it will be difficult to pass this type of legislation, but it is something the retail industry will once again need to defend. However, RILA doesn’t expect the Trump administration to directly interfere with the Federal Reserve’s proposed debit interchange rule as it is unveiled in 2025.

During the Lame Duck session there will be a continued push to bring more competition to the credit card market by trying to pass the Credit Card Competition Act (CCCA), introduced by Sens. Durbin (D-IL) and Marshall (RKS). The CCCA expands the dual routing provision that has brought more competition in the debit lane to the credit card market. If no action is taken during the remainder of this Congress, the legislation will be a top priority in the 119th Congress.

RILA POSITION

RILA will continue to advocate for more competition in the payment’s ecosystem at the primary regulators and on Capitol Hill. This includes advancing the recent Federal Reserve proposed rule to lower the debit interchange rate as well as lobbying in the Halls of Congress to bring reform to the broken credit card market.

For more information about RILA’s advocacy efforts around this issue, please reach out to RILA EVP of Government Affairs Austen Jensen.

Want more election insights? Dive into our policy outlooks on more retail focus areas below.

• Tax

• Workforce

• Privacy & AI (coming soon)

• Supply Chain and Transportation & Infrastructure

• Organized Retail Crime (coming soon)

Tags

-

Payments

-

Public Policy

-

Finance

-

Supporting Free Markets and Fostering Innovation